Discover the top 4 investment approaches for ETF mutual funds with HDFC SKY – an innovative digital investment platform by HDFC Securities. Offering zero account-opening fees and lifetime zero brokerage on ETFs, HDFC SKY provides users with a seamless trading experience across various segments, advanced tools, and expert recommendations.

Introduction to ETF Mutual Funds

HDFC SKY introduces users to the world of Exchange-Traded Fund (ETF) mutual funds, which are a type of investment fund that is traded on stock exchanges. These funds combine the features of mutual funds and individual stocks, providing investors with diversified portfolios at a lower cost. With HDFC SKY, investors can access a wide range of ETF mutual funds without any account-opening fees and benefit from lifetime zero brokerage on these funds. This platform offers a flat commission rate of across segments, making it cost-effective for users to invest in ETF mutual funds and diversify their portfolios.

By offering ETF mutual funds on its digital investment platform, HDFC SKY empowers users to build a well-balanced investment portfolio with ease. Through this platform, investors can trade ETF mutual funds along with other investment options such as stocks, F&O, commodities, and IPOs. Additionally, users can leverage advanced tools like margin trading, research recommendations, interactive charts, and an AI assistant to make informed investment decisions. With the convenience of a single platform, investors can explore and invest in a variety of ETF mutual funds to achieve their financial goals efficiently and cost-effectively.

MTF enhances this experience by allowing investors to amplify potential returns through leveraged positions. This feature, integrated seamlessly within HDFC SKY, enables users to maximize their investment opportunities while maintaining control and understanding of their risk exposure, ensuring a comprehensive investment strategy.

Benefits of Investing in ETF Mutual Funds

Investing in ETF mutual funds through HDFC SKY offers numerous benefits to investors. Firstly, the platform provides zero account-opening fees, making it accessible to a wide range of investors looking to diversify their portfolios. The lifetime zero brokerage on ETFs is a significant advantage, as it reduces the overall cost of investing and maximizes returns for investors. With a flat commission across segments, investors can trade various financial instruments without worrying about high transaction costs, thereby enhancing their investment experience.

Furthermore, HDFC SKY’s digital investment platform offers users the opportunity to invest in a range of financial products, including stocks, mutual funds, F&O, commodities, and IPOs. This diversity allows investors to create a well-rounded investment portfolio tailored to their financial goals and risk tolerance. Additionally, the platform provides advanced tools such as margin trading, research recommendations, charts, and an AI assistant, empowering investors to make informed decisions and optimize their investment strategies. Overall, investing in ETF mutual funds through HDFC SKY not only offers cost-effective solutions but also provides a comprehensive suite of tools and resources to help investors succeed in the financial markets.

Active vs. Passive Investment Strategies

Active and passive investment strategies represent two distinct approaches to managing an investment portfolio. Active investment involves hands-on decision-making by a portfolio manager or investor, who seeks to outperform the market through frequent buying and selling of securities. This strategy often requires in-depth research, market monitoring, and a willingness to take on higher risks in pursuit of higher returns. Investors following an active strategy may choose individual stocks, mutual funds, or other assets based on their analysis of market trends, company performance, and economic factors. HDFC SKY, with its comprehensive digital investment platform, caters to active investors by providing access to a wide range of investment options and advanced tools for analysis and decision-making.

On the other hand, passive investment strategies aim to track a specific market index or benchmark, such as the Nifty 50 or S&P 500, by investing in a diversified portfolio of assets that mirror the index composition. Passive investors typically follow a “buy-and-hold” approach, minimizing trading activity and focusing on long-term growth rather than actively managing their investments. This strategy is often associated with lower costs, as passive funds usually have lower fees compared to actively managed funds. HDFC SKY, with its offering of zero brokerage on ETFs and flat commissions, caters to passive investors looking for cost-effective ways to build a diversified portfolio and participate in the broader market trends.

Equity Margin Calculator is one of the smart tools offered by HDFC SKY, enabling investors to efficiently manage their portfolios while benefiting from zero brokerage on a diverse range of investment options, thus aligning with their long-term financial goals.

Factors to Consider When Selecting ETF Mutual Funds

When selecting ETF mutual funds through HDFC SKY, investors should consider several key factors to make informed decisions. One crucial aspect to evaluate is the fund’s expense ratio, as it directly impacts the returns investors receive. Lower expense ratios typically translate to higher returns for investors. Additionally, investors should assess the fund’s tracking error, which measures how closely the ETF follows its underlying index. A low tracking error indicates that the fund accurately mirrors the index’s performance, making it a more reliable investment option. Moreover, investors should consider the liquidity of the ETF, as higher liquidity ensures that investors can easily buy or sell shares at fair market prices, minimizing the impact of bid-ask spreads on their investments.

Another factor to consider when selecting ETF mutual funds is the fund’s underlying index and sector exposure. Investors should align the fund’s investment objectives with their own financial goals and risk tolerance. Understanding the index composition and sector allocations can help investors gauge the fund’s diversification and evaluate its potential for growth. Additionally, investors should analyze the historical performance of the ETF to assess its consistency and volatility. By examining past returns and risk metrics, investors can gain insights into how the ETF may perform in various market conditions and make more informed investment decisions through HDFC SKY’s digital platform.

Diversification and Risk Management in ETF Investing

Diversification and risk management play a crucial role in ETF (Exchange-Traded Fund) investing, especially when using platforms like HDFC SKY offered by HDFC Securities. ETFs are known for providing diversified exposure to a basket of securities, which can help spread the risk across different assets. By investing in a range of ETFs across various sectors, regions, and asset classes, investors can reduce the impact of market volatility on their portfolio. HDFC SKY’s zero brokerage on ETFs and flat commission rates make it easier for investors to build a diversified ETF portfolio without incurring high transaction costs, thus promoting efficient risk management strategies.

Moreover, HDFC SKY’s digital investment platform offers users the flexibility to easily rebalance their ETF holdings to maintain their desired asset allocation. This feature allows investors to adjust their portfolio according to changing market conditions or their risk tolerance level. Additionally, the platform provides access to advanced tools such as research recommendations, charts, and an AI assistant, enabling investors to make informed decisions about their ETF investments. By utilizing these tools effectively, investors can enhance their risk management practices and optimize their ETF portfolio for long-term growth and stability.

Top ETF Mutual Funds for Different Investment Goals

For investors with different investment goals, choosing the right ETF mutual funds can play a crucial role in achieving financial objectives. HDFC SKY stands out as an attractive option for those looking for a comprehensive digital investment platform. With zero account-opening fees and lifetime zero brokerage on ETFs, HDFC SKY offers a cost-effective solution for investors seeking to build a diversified portfolio. The flat commission across segments makes it easy for users to invest in a wide range of assets, including stocks, mutual funds, F&O, commodities, IPOs, and more. Additionally, the platform provides access to advanced tools such as margin trading, research recommendations, charts, and an AI assistant, empowering investors to make informed decisions and optimize their investment strategies.

Whether investors are looking to build wealth for the long term, save for retirement, or achieve specific financial goals, having access to a diverse range of ETF mutual funds can help them tailor their investment approach. HDFC SKY’s offering of ETF mutual funds caters to various investment goals, providing investors with the flexibility to choose funds that align with their risk tolerance and time horizon. By offering low-cost investing options and a user-friendly platform, HDFC SKY enables investors to easily diversify their portfolios and capitalize on market opportunities. With the convenience of trading multiple asset classes and access to advanced tools, HDFC SKY positions itself as a top choice for investors seeking to achieve their investment goals efficiently and effectively.

Margin Trading further enhances HDFC SKY’s robust offerings, allowing investors to leverage their positions for potentially higher returns. This facility, combined with zero-brokerage benefits and expert research, empowers investors to navigate market dynamics with confidence and precision.

Performance Evaluation of ETF Mutual Funds

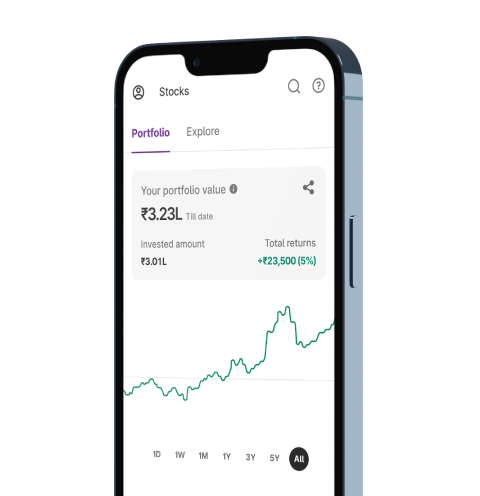

When evaluating the performance of ETF mutual funds on the HDFC SKY platform, investors can benefit from the user-friendly interface that provides comprehensive data and analysis tools. The platform’s zero account-opening fees and lifetime zero brokerage on ETFs make it cost-effective for investors to build diversified portfolios through ETFs. With flat commissions across segments, investors can efficiently manage their investments without incurring high transaction costs. The platform’s integration of various investment options, including stocks, mutual funds, F&O, commodities, IPOs, and advanced tools such as margin trading, research recommendations, charts, and an AI assistant, offers investors a holistic investment experience.

Investors can track the performance of ETF mutual funds on HDFC SKY using real-time data and customizable charts to make informed investment decisions. The platform’s research recommendations and AI assistant provide valuable insights and guidance for investors to optimize their portfolio strategies. With the ability to trade ETFs with zero brokerage fees for a lifetime, investors can enhance their returns by minimizing costs. The seamless integration of various investment products on the platform allows investors to diversify their portfolios efficiently. Overall, the performance evaluation of ETF mutual funds on HDFC SKY is supported by a range of features that empower investors to navigate the market with confidence and convenience.

Tax Efficiency and Cost Considerations

Tax efficiency is a crucial aspect of investing that can significantly impact an investor’s overall returns. HDFC SKY’s all-in-one digital investment platform provides users with the opportunity to make tax-efficient investment decisions. By offering access to a range of investment products such as ETFs, mutual funds, and equities, investors can strategically allocate their assets to minimize tax liabilities. Additionally, with lifetime zero brokerage on ETFs and flat commissions across segments, investors can execute trades at a lower cost, thereby maximizing their after-tax returns.

Cost considerations play a vital role in shaping an investor’s overall investment strategy. With HDFC SKY’s competitive pricing structure, investors can benefit from cost-effective trading solutions while accessing a wide array of investment options. By eliminating account-opening fees and offering flat commissions, investors can save on unnecessary expenses, allowing them to allocate more capital towards their investments. This cost-efficient approach not only enhances the investor’s portfolio performance but also fosters a sustainable investment strategy in the long run.

Market Trends Impacting ETF Mutual Fund Investments

Market trends play a significant role in shaping the performance and popularity of ETF mutual fund investments. One key trend impacting these investments is the increasing demand for passive investing strategies. ETFs, being a type of passive investment vehicle, have gained traction among investors seeking low-cost and diversified exposure to various asset classes. The rise of robo-advisors and digital investment platforms like HDFC SKY has further fueled the growth of ETFs, as they provide convenient access to these investment products with minimal fees and hassle-free trading experience. As more investors opt for ETFs over actively managed mutual funds, the market trend towards passive investing is likely to continue shaping the landscape of the investment industry.

Another market trend impacting ETF mutual fund investments is the growing focus on environmental, social, and governance (ESG) investing. With increasing awareness about sustainability and ethical investing practices, there has been a surge in demand for ESG-focused ETFs that align with investors’ values and beliefs. As more investors prioritize ESG considerations in their investment decisions, fund managers are launching specialized ETFs that integrate ESG factors into their investment strategies. This trend not only reflects a shift towards socially responsible investing but also presents opportunities for investors to align their portfolios with their ethical and sustainable goals through ETF mutual fund investments.

Stock trading app platforms like HDFC Sky are increasingly catering to this demand by providing users with access to a variety of ESG-focused ETFs. This empowers investors to effortlessly incorporate sustainable investments into their portfolios while benefiting from low-cost, expert-driven insights.

Tips for Successful ETF Mutual Fund Investing

Successful ETF mutual fund investing requires a strategic approach and diligent research. One key tip is to diversify your investments across different asset classes and sectors to reduce risk. By spreading your investments across various ETFs, you can minimize the impact of volatility in any single sector. Additionally, it’s essential to understand the underlying assets of the ETFs you are investing in. Conduct thorough research on the ETF’s holdings, expense ratio, past performance, and tracking error to make informed decisions. HDFC SKY’s digital investment platform can be a valuable tool in this regard, providing access to advanced research recommendations and tools to help you make well-informed investment choices.

Another crucial tip for successful ETF mutual fund investing is to maintain a long-term perspective. ETFs are designed to track specific indexes or sectors, and they may experience fluctuations in the short term. It’s important to stay focused on your investment goals and avoid making impulsive decisions based on short-term market movements. Regularly review your investment portfolio and consider rebalancing it periodically to ensure it aligns with your financial objectives. With HDFC SKY offering zero brokerage on ETFs and a flat commission rate, investors can benefit from cost-effective trading while building a diversified portfolio for long-term growth.